In this comprehensive guide, we will walk you through the process of registering for the Social Security System (SSS) online in the Philippines. SSS is a crucial government agency that provides social security benefits to Filipino citizens, and being able to register online can save you time and effort. Whether you’re a first-time registrant or need to update your existing SSS account, this step-by-step guide will make the process smooth and hassle-free.

Transacting in an SSS office is like traversing EDSA during a rush-hour—waiting takes forever. Although the actual transaction gets done in just a few minutes, standing in long lines usually takes longer than an hour.

Unless you have an endless supply of patience and a lot of time to waste, please take advantage of the online services through the My.SSS portal to transact with the SSS within minutes. To access this portal, you must register your SSS account online first.

Here’s how to register SSS online to help make the account creation process smooth and hassle-free.

What is Social Security System?

The Social Security System (SSS) is a prominent government-run organization in the Philippines dedicated to offering comprehensive social protection to its members. This coverage encompasses essential benefits such as retirement benefits, financial support in the event of death, and assistance for individuals facing disabilities.

The Philippines’ SSS membership is not limited solely to employed individuals; it is obligatory for all those engaged in gainful employment. Additionally, self-employed individuals and voluntary members have the option to register and enjoy the security and advantages provided by the SSS.

Why do we Need to Have an SSS Number?

Having an SSS number is indispensable for several reasons:

- Access to Social Security Benefits – As an SSS member, you gain access to a range of benefits, such as retirement, disability, and death benefits. These benefits provide crucial financial support during challenging times.

- Employment Requirements – Most employers in the Philippines require their employees to have an SSS number. It serves as evidence that employees are contributing to their social security and are eligible for the associated benefits.

- Business Registration – If you’re contemplating starting a business in the Philippines, obtaining an SSS number is a mandatory step in registering your business with the government.

Benefits of Being an SSS Member

As an SSS member, you are entitled to a variety of benefits tailored to cater to your needs. These benefits include:

- Sickness Benefit: A daily cash allowance for members unable to work due to sickness or injury.

- Maternity Benefit: A daily cash allowance granted to female members who are unable to work due to childbirth or miscarriage.

- Disability Benefit: A cash benefit provided to members who become permanently disabled, either partially or totally.

- Retirement: A cash benefit granted to members who can no longer work due to old age, either as a monthly pension or a lump sum amount.

- Death Benefit: A cash benefit given to the beneficiaries of a deceased member, either as a monthly pension or a lump sum amount.

- Funeral Benefit: A cash benefit to cover the funeral expenses of the deceased member.

- Salary Loan: A cash loan offered to members for short-term financial needs.

- Unemployment Benefit: A cash benefit granted to covered employees, including Kasambahay and OFWs, who are involuntarily separated from employment.

- Employees’ Compensation: Sickness or death benefit for a member directly related to work.

Who Qualifies for an SSS Number in the Philippines?

If you are a Filipino citizen aged 60 years old and below and have not been issued a social security number, you are required to obtain an SSS number. Various categories of individuals are eligible for an SSS number in the Philippines, including:

- Employees: Private sector employees, household service workers, seafarers, and those employed by foreign governments or international organizations are all required to register and obtain an SSS number.

- Self-Employed Persons: Professionals, entrepreneurs, farmers, fishermen, informal workers, contractual government employees, actors, athletes, and more are mandated to register if they earn at least PHP 1,000 per month from their own businesses or professions.

- Overseas Filipino Workers (OFWs): All OFWs are now mandatory members of the SSS, including those recruited in the Philippines for foreign employment, Filipinos earning income abroad, and permanent residents in other countries.

- Non-Working Spouse: Legal spouses of SSS members who manage the household full-time and are not yet SSS members themselves qualify for an SSS number.

How to Get an SSS Number?

Getting an SSS number is a simple and straightforward process. Here’s a step-by-step guide on how to get an SSS number. First let us determine the documentary requirements.

List of Documentary Requirements:

- Birth Certificate

- In the absence, any of the following documents:

- Baptismal Certificate, or its equivalent

- Passport

- Driver’s License

- Professional Regulation Commission (PRC) card

- Seaman’s Book (Seafarer’s Identification and Record Book)

- In the absence of the above, any two (2) of the following secondary documents are acceptable, indicating both with the correct name and at least one (1) with the correct date of birth:

- Alien Certificate of Registration

- Automated Teller Machine (ATM) card with the cardholder’s name

- Bank Account Passbook

- Birth or Baptismal Certificate of child/ children, or its equivalent

- Certificate of Licensure/Qualification Document from the Maritime Industry Authority

- Certificate of Confirmation issued by the National Commission on Indigenous Peoples

- Certificate of Muslim Filipino Tribal Affiliation issued by the National Commission on Muslim Filipinos

- Company ID card

- Court order granting petition for change of name or date of birth

- Credit card

- Firearm License card issued by the Philippine National Police;

- Fishworker’s License issued by the Bureau of Fisheries and Aquatic Resources

- Government Service Insurance System (GSIS) card/ Member’s Record/ Certificate of Membership

- Health or Medical card

- Home Development Mutual Fund (PAGIBIG) Member’s Data Form/Transaction card

- Homeowners Association ID card

- ID card issued by Local Government Units (e.g. Barangay/Municipality/City)

- ID card issued by professional associations recognized by the PRC

- Life Insurance Policy

- Marriage Contract/Certificate

- National Bureau of Investigation (NBI)

- Overseas Workers Welfare Administration (OWWA) card

- Philippine Health Insurance Corporation (Philhealth) Member’s Data Record/ID card

- Police Clearance

- Postal ID card

- School ID card

- Seafarer’s Registration Certificate issued by the Philippine Overseas Employment Administration

- Senior Citizen card

- Student Permit issued by the Land Transportation Office

- Taxpayer’s Identification Number card

- Transcript of Records

- Voter’s ID card/Affidavit/Certificate of Registration with the Commission on Elections

Please take note on the following additional requirements:

If Married, bring a copy of your marriage certificate.

If with Children, bring copy of the birth certificate.

For Non- Working Spouse, the working spouse must sign his/her name on the printed Personal Record Form. The signature means that the spouse agrees with the SSS membership.

Understanding the Importance of SSS Registration

Before we dive into the registration process, let’s briefly discuss why it’s essential to be an SSS member. SSS provides financial assistance to members and their beneficiaries in times of need, such as sickness, disability, retirement, and even during unfortunate events like death. By becoming an SSS member and regularly contributing to your account, you are securing your financial future and that of your loved ones.

Why Register for an Online SSS Account?

In a word: convenience. An online SSS account streamlines your interactions with the SSS, saving you time and effort. You’ll bid farewell to taking a day off to spend hours at the SSS office, enduring long queues, and navigating busy phone lines.

With an online account, you can transact with the SSS swiftly and securely from the comfort of your home or office, as long as you have a computer or handheld device with internet access.

To access the My.SSS portal, members and employers must register and create their accounts, ensuring that their information remains secure and protected from identity theft. Members can designate their User ID and set their preferred password upon successful registration. Employers, on the other hand, can designate their User ID, with a user-generated password sent to their email following successful registration.

SSS Online Services for Members

SSS members can avail of a plethora of services through the new SSS online Member Portal, including:

- View SSS membership details (SSS number, date of coverage, coverage status, etc.)

- Check SSS contributions and employment history

- Request records such as Personal Record (Form E-1), Member Data Change Request (Form E-4), Self-Employed Data Record (RS-1), Non-Working Spouse Record (Form NW-1), and Overseas Worker Record (Form OW-1)

- Set an appointment with an SSS branch for transactions that can’t be done online (UMID card application, update membership details, etc.)

- Apply for retirement benefits

- Apply for unemployment benefits

- Change/reset the password

- Generate Payment Reference Number (PRN)

- Apply for a salary loan

- View loan information and status

- Compute the retirement benefit amount

- Submit maternity notification (Available only to self-employed, voluntary, OFW, and non-working spouse members. For employees, their employers must file it online.)

- Update your contact details and mailing address

- Pay SSS contributions using Moneygment

SSS Online Services for Employers

Employers can easily complete various tasks online with a My.SSS employer account, including:

- Checking SSS membership records.

- Reviewing paid contributions.

- Monitoring remitted loan repayments for employees.

- Keeping track of sickness and maternity reimbursement claims.

- Submitting employment reports (Form R-1A).

- Submitting contribution collection lists (Form R-3).

- Submitting loan collection lists (Form ML-2).

- Filing maternity notifications for employees.

- Certifying employees’ salary loan applications.

Streamline Your SSS Transactions with My.SSS Portal

In today’s fast-paced world, waiting in long lines at an SSS office can feel like an eternity. The actual transaction might take just a few minutes, but the wait often stretches beyond an hour. Unless you have an infinite reserve of patience and time to spare, it’s time to leverage the online services offered through the My.SSS portal for swift and hassle-free interactions with the Social Security System (SSS).

What Is My.SSS Portal?

My.SSS is the online service portal that empowers SSS members and regular/household employers to access their records and execute various transactions with the SSS efficiently. This portal allows members to schedule appointments with their SSS servicing branch, make simple corrections to their membership data, and generate their Statement of Account (SOA), which contains the Payment Reference Number (PRN) needed to settle contributions or loans. Employers can also access their My.SSS accounts to generate the Contributions Collection List, which contains the PRN required for remitting employees’ contributions.

Evolution of My.SSS Portal

The My.SSS portal has evolved over the years to offer enhanced functionality and accessibility. In August 2018, the SSS introduced an updated version known as the My.SSS Beta Portal or SSS Member Portal. This revamped portal retained most of the features of the old one but boasted a more mobile-friendly design, ensuring users could access their accounts effortlessly from smartphones and tablets.

However, the old portal continued to coexist alongside the new one. Members could use the same username and password for either portal, providing them with flexibility. But as of 2020, the SSS merged the two portals to eliminate confusion and streamline all SSS online activities. The new My.SSS portal is compatible with a variety of browsers, including Google Chrome, Safari, Mozilla Firefox, and Opera Mini, making it a more versatile platform compared to the old portal, which only supported Internet Explorer version 11.

Who Can Register at My.SSS?

- SSS Members: SSS membership encompasses a broad spectrum, including employees (including kasambahay), self-employed individuals, voluntary contributors, overseas Filipino workers (OFWs), and non-working spouses. To create an online SSS account, you must meet the following prerequisites:

- Have at least one-month of posted contributions.

- Possess a valid SSS number.

- Exhibit a valid date of coverage (indicating when your SSS coverage commenced, typically when your employer reported you for coverage or when you initially contributed as a self-employed/non-working spouse/OFW member).

Note: Employed members who recently separated from their employers but haven’t made contributions as voluntary or self-employed members must adhere to the latest update on their SSS membership. They should initially register as employed members, inputting the Employer ID of their previous employer who reported them for coverage. They can only switch their membership category to voluntary after making their first contribution.

- Business/Regular Employers: Companies and non-profit organizations registered with the SSS as employer members are eligible for an SSS online employer account.

- Household Employers: Household employers who hire at least one house helper can register online provided they meet specific criteria:

- Possess a valid SSS number.

- Have been reported for coverage either as an employed, self-employed, voluntary, non-working spouse, or OFW member.

- Have at least one-month of posted contributions.

Why Register for an Online SSS Account?

In a word: convenience. An online SSS account streamlines your interactions with the SSS, saving you time and effort. You’ll bid farewell to taking a day off to spend hours at the SSS office, enduring long queues, and navigating busy phone lines.

With an online account, you can transact with the SSS swiftly and securely from the comfort of your home or office, as long as you have a computer or handheld device with internet access.

To access the My.SSS portal, members and employers must register and create their accounts, ensuring that their information remains secure and protected from identity theft. Members can designate their User ID and set their preferred password upon successful registration. Employers, on the other hand, can designate their User ID, with a user-generated password sent to their email following successful registration.

SSS Online Services for Members

SSS members can avail of a plethora of services through the new SSS online Member Portal, including:

- Viewing SSS membership details (SSS number, date of coverage, coverage status, etc.).

- Checking SSS contributions and employment history.

- Requesting records such as Personal Record (Form E-1), Member Data Change Request (Form E-4), Self-Employed Data Record (RS-1), Non-Working Spouse Record (Form NW-1), and Overseas Worker Record (Form OW-1).

- Scheduling appointments with an SSS branch for transactions that can’t be conducted online (e.g., UMID card application, membership details update).

- Applying for retirement benefits.

- Applying for unemployment benefits.

- Changing/resetting the password.

- Generating Payment Reference Numbers (PRN).

- Applying for a salary loan.

- Viewing loan information and status.

- Computing retirement benefit amounts.

- Submitting maternity notifications (available to self-employed, voluntary, OFW, and non-working spouse members; employees must have their employers file it online).

- Updating contact details and mailing addresses.

- Paying SSS contributions using Moneygment.

SSS Online Services for Employers

Employers can easily complete various tasks online with a My.SSS employer account, including:

- Checking SSS membership records.

- Reviewing paid contributions.

- Monitoring remitted loan repayments for employees.

- Keeping track of sickness and maternity reimbursement claims.

- Submitting employment reports (Form R-1A).

- Submitting contribution collection lists (Form R-3).

- Submitting loan collection lists (Form ML-2).

- Filing maternity notifications for employees.

- Certifying employees’ salary loan applications.

How To Register SSS Online as a Member

The process of registering with SSS online has evolved and streamlined, allowing members to complete their registration via the new and improved SSS website. Here’s a step-by-step guide:

1. Go to the official SSS website

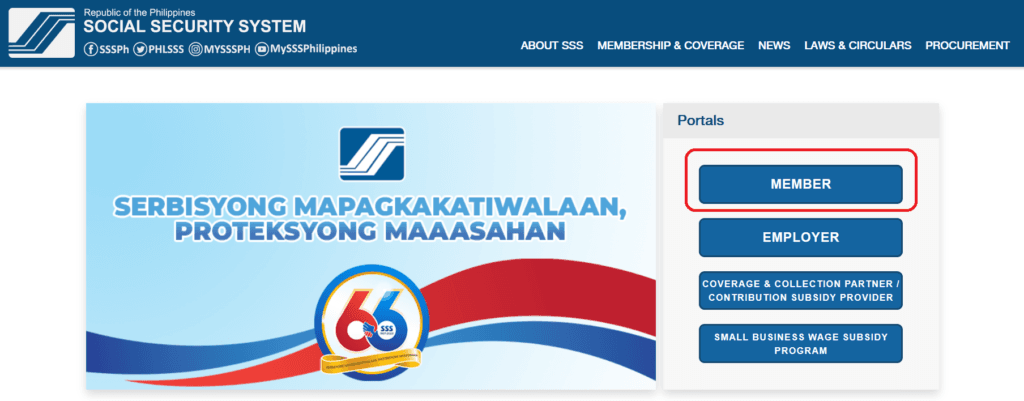

Upon arriving at the SSS website, you’ll find four portals: Member, Employer, Coverage and Collection Partner/Contribution Subsidy Provider and Small Business Wage Subsidy Program. As a regular-paying member, select “Member.”

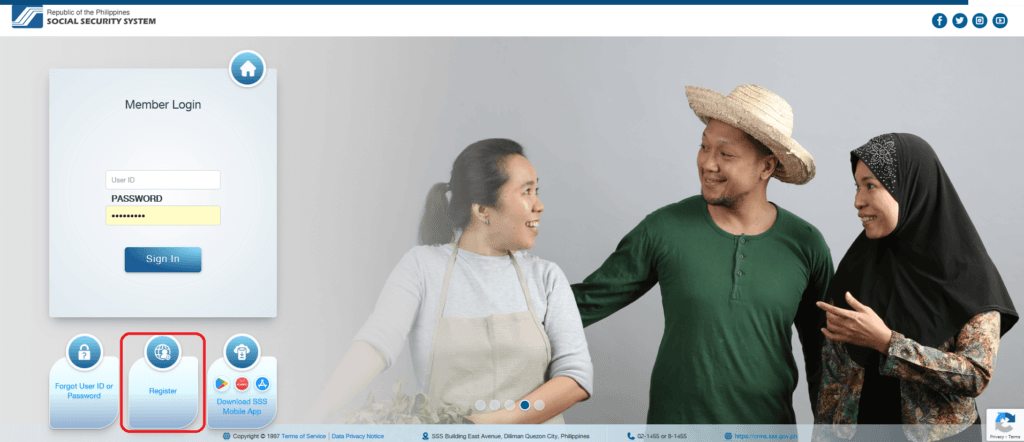

2. Click the registration link on the SSS Member Login page

If you haven’t registered your SSS account online yet, locate the link at the bottom of the SSS Member Login page that reads “Not yet registered in My.SSS?” and click it.

Click the said link to proceed with the online registration.

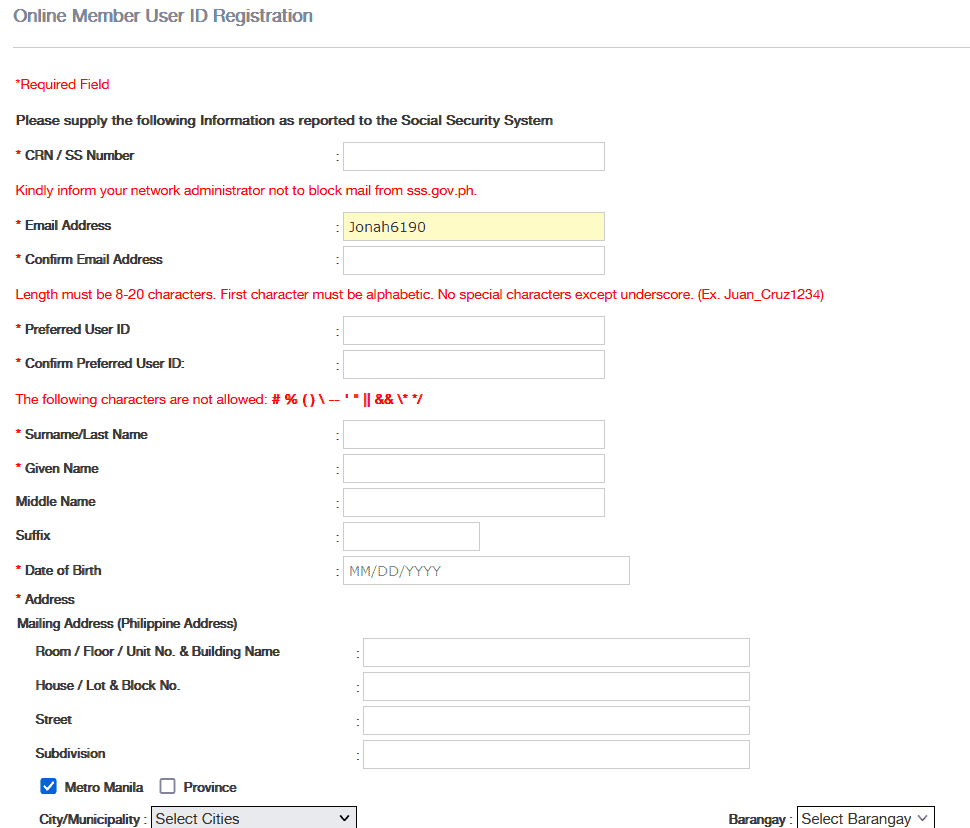

3. Fill out the SSS Online Member User ID Registration form

Provide the following information completely and correctly:

- CRN/SS Number. The 12-digit CRN is the Common Reference Number found on your UMID card. If you don’t have this ID card yet, enter your 10-digit SSS number found in the upper right corner of your Personal Record form (E-1)—with no space or hyphen (-).

- Email address. Provide an active and valid email address you’ve never used to register at My.SSS. Re-enter your email address in the following field, Confirm Email Address. If the system doesn’t accept it, provide a different email address, or create a new one. Enter an email address created via yahoo.com, gmail.com, or hotmail.com. If you’re using an email address from another provider, make sure to inform the network administrator to whitelist or not block any email from sss.gov.ph

- User ID. You’ll use the User ID to access your SSS online account. It should have 8 to 20 alphanumeric characters (a combination of alphabets and numbers), with the first character being an alphabet. Special characters are not allowed, except for underscores (_). Re-enter your user ID on the next field to confirm it.

- Complete name. The fields designated for your name don’t allow the following special characters: # % ( ) — ‘ ” || && * */. As for the middle name, you can leave it blank if you don’t have one.

- Date of birth. Your birthdate should follow the MM/DD/YYYY format (e.g., 08/09/1992). Choose it from the drop-down menu instead of manually typing it.

- Mailing address (Philippine address). If a particular field is not applicable (i.e., you don’t live in a subdivision or condominium), leave it blank. Depending on where you reside, you can tick the box corresponding to either Metro Manila or Province. If you select Metro Manila, you’ll then be asked to choose your city/municipality and barangay from the drop-down lists provided. If you select Province, you’ll be asked to choose the name of your province, city/municipality, and barangay from the drop-down lists provided. There is no need to input your postal code, as it will be automatically generated after selecting your province, city/municipality, and barangay.

- Foreign mailing address (if applicable). If you’re currently based abroad, you can also opt to provide your foreign mailing address. Enter your address, city, ZIP code, and current country of residence.

- Registration Preference. Choose one personal information you reported to SSS to proceed with the online registration. You’ll be asked to choose from eight options. Click the one familiar to you to which you can provide the requested information. Here’s a summary of the available options:

- Savings Account Number – This applies to SSS pensioners. Enter the bank account number (must be registered in the SSS) you’re using to receive your monthly pension. It can be a Citibank cash card, UnionBank SSS Quick Card, or UMID-ATM savings account number.

- Mobile Number Registered in SSS – The cellphone number you registered in the SSS (not necessarily your current mobile number). Find it on your E-1 form or the latest Member Data Change Request form (if you’ve updated your member records).

- UMID Card – Provide either your PIN code (which you got when you activated your UMID card in the SSS Information Terminal at an SSS branch) or your mother’s maiden name (as indicated on your birth certificate).

- Employer ID Number / Household Employer ID Number – If you can contact one of your previous employers, ask HR for the SSS employer ID number. Meanwhile, if you’re a kasambahay, you may enter your boss’s employer ID number instead.

- Paid Payment Reference Number / SBR No. / Payment Receipt Transaction Number – Get this info from the latest official receipt when you paid your SSS contribution as a self-employed, voluntary, non-working spouse, or OFW member. Alternatively, you can provide any receipt number on the special bank receipt or the Contributions Payment Return (Form RS-5) paid within the past six months.

- Date of Loan with Existing Loan Balance – If you have an existing SSS loan, indicate the exact date of the loan in this format: MM/DD/YYYY.

- Transaction Number shown in your Personal Record/Unified Multi-Purpose ID (UMID) Application (E-1/E-6) – You can provide this information if you applied for an SSS number online from December 10, 2020, onwards.

- Check Number – If you’re a member receiving your monthly retirement or disability pension benefit through a check, you can find this information on the check itself.

Review all details and make any necessary corrections. When you’re done, tick the boxes next to I’m not a robot and I accept the Terms of Service at the bottom of the page.

Finally, click Submit.

4. Check your email for the notification from SSS, then click on the activation link

Upon completing your registration for the Social Security System (SSS) online, here are the steps you should follow to activate your SSS online account:

- Check Your Inbox: Within 30 minutes after registering, keep an eye on your email inbox. You should receive an email with the subject line “SSS Web Registration” from notifications@sss.gov.ph. If you don’t see it in your inbox, be sure to check your Spam or Trash folder as well.

- Open the Email: Once you locate the email, open it to access the activation link.

- Activate Your Account: Inside the email, you will find a hyperlinked word, typically “clicking here.” Click on this link to activate your SSS online account. This step is essential to gain access to the online services provided by the SSS.

- Act Promptly: Keep in mind that the activation link has an expiration period of five working days. Therefore, it’s crucial to activate your account promptly to avoid any issues. If you miss the deadline, you will need to start the registration process over again.

- Set Your Password: After clicking the activation link, you will typically be prompted to set your password for your SSS online account. Follow the instructions provided to create a secure password.

Please note that during the activation process, only your user ID will be sent to your email. You are responsible for setting your password securely. Once you have successfully completed these steps, you will have full access to your SSS online account, allowing you to manage your contributions and access various SSS services.

5. Create your password

When activating your SSS online account and setting your password, follow these steps for a secure and successful process:

- Activation Link: After clicking the activation link sent to your email, you will be directed to the “Set Password Page.” This page is where you can establish a secure password for your SSS online account.

- Additional Security Step: Before setting your preferred password, you will be prompted to enter the last six digits of your CRN (Common Reference Number) or SSS number. This added layer of security ensures that only authorized users can set a password and gain access to your account.

- Click Submit: After entering the required digits, click the “Submit” button to proceed.

- Password Requirements: You can now create your preferred password, which should adhere to the following criteria:

- The password must be between eight (8) to twenty (20) characters in length.

- It should start with an alphabet.

- Special characters such as asterisks, exclamation points, and percent symbols are not allowed.

- Importantly, your password must be different from your user ID.

- Enter and Confirm Password: Enter your chosen password and type it again in the following field to confirm it, ensuring that both entries match.

- Final Submission: When you have successfully entered and confirmed your password, click the “Submit” button to finalize the process.

Following these steps will help you create a secure and compliant password for your SSS online account, ensuring the safety of your personal information and account access.

6. Proceed to SSS Member Login

Go to the SSS Member Portal and log in with your user ID and password.

You can now explore the various features on the portal, such as your membership information and contributions.

How To Register SSS Online as an Employer

The SSS online registration procedure for employers is different from individual members. Here are the steps to create an online account if you’re an employer:

1. Go to the official SSS website

Since you’ll register as an employer, click on the Employer portal.

2. Click on the registration link that corresponds to your employer category

Once you are on the Employer Login page, scroll down to the bottom of the page. You will see a section that says “Not yet registered in My.SSS?” with registration links for different employer categories.

Choose between Regular Employer and Household Employer. Regular employers are those who run registered businesses, while household employers, as the name suggests, are employers who have hired a kasambahay to take care of household chores.

3. Fill out the registration form

Upon clicking the appropriate registration link, you’ll be directed to either of these registration forms:

a. Household employers.

b. Regular (business/corporate) employers.

nce on the registration page, you’ll be presented with a form. Carefully fill out all the required fields, marked with a red asterisk (*). Pay special attention to the following details:

- Employer ID: Enter your 10-digit employer number without spaces or hyphens. You can find this number on your Employer Registration form (Form R-1), Employer Registration Plate, or SSS Certificate of Registration.

- Employer Branch Code: If your business has a branch office, input the appropriate branch code. Otherwise, leave it unchanged.

- Date of Coverage: Provide the month and year you hired your first employee(s). You can find this information in your Form R-1 or Registration Plate. Use the drop-down menus to select the month and year, and set the default day to 1.

- Postal Code: Enter the correct 4-digit postal code for your current business address. This code will determine your SSS servicing branch.

- Company Email Address: Provide a valid and active email address used for business purposes, not a personal email.

- Preferred User ID: Create a user ID with 8 to 20 alphanumeric characters. It must start with a letter and can include underscores (_) but no special characters. Confirm your user ID by entering it again in the following field.

After filling out all the required information, double-check for accuracy. Enter the code shown on the page, which may be a CAPTCHA or security code, and click the “Submit” button to complete the registration.

4. Activate your online account

To activate your My.SSS account as an employer, follow these steps:

- Check Your Inbox and Spam Folder: Look for a message from the Social Security System (SSS) in your email inbox. If you can’t find it in your inbox, check your spam or junk folder as sometimes legitimate emails can end up there.

- Click the Activation Link: In the email from SSS, there should be a provided activation link. Click on this link to initiate the activation process.

- Complete the Online Form: You will be directed to an online form where you need to provide details about your authorized signatory. The authorized signatory is the company representative authorized to certify and sign SSS documents on behalf of the employer. Depending on your business structure:

- Single Proprietor: If you are a single proprietor, check the “Single Proprietor” box and enter your own details, including your SSS number, complete name, and email address.

- Corporation or Cooperative: If you own a corporation or cooperative with an authorized signatory, provide the signatory’s details, including their SSS number, complete name, and email address.

- Accept the Terms of Service: Make sure to read and understand the Terms of Service, then check the “I accept the Terms of Service” box.

- Submit the Form: After completing the form and accepting the terms, click the “Submit” button.

- Confirmation: You should receive a notification confirming that your registration application has been sent to the SSS for validation. It also indicates that you’ll receive an email regarding the validation results.

- Wait for Validation Results: Keep an eye on your email for the validation results from SSS. They will notify you once your registration is validated and your My.SSS employer account is activated.

5. Check your company email for a validation message

Your SSS servicing branch will verify if your authorized signatory is included in your company’s Specimen Signature Card (Form L-501).

Once the SSS approves your authorized signatory, it will send you a message through email with your company user ID and a system-generated password.

6. Access your online employer account

To complete the activation process for your My.SSS employer account, follow these steps:

- Verification by SSS Servicing Branch: The SSS servicing branch will verify whether your authorized signatory is included in your company’s Specimen Signature Card (Form L-501). This step ensures that the authorized person can act on behalf of your company regarding SSS matters.

- Email Notification: After the verification process, the SSS will send you an email notification. This email will contain important information, including your company user ID and a system-generated password.

- Access Your Account: Once you receive the email, you can use the provided company user ID and password to access your My.SSS employer account. Make sure to keep this information secure, as it is essential for managing your SSS transactions online.

By following these steps, you’ll successfully activate your My.SSS employer account and gain access to the SSS online services for employers.

Tips and Warnings for Easy Access of your SSS Account

1. Access the SSS portal during off-peak periods

To avoid slow loading times or inaccessibility, try to access the My.SSS portal during off-peak periods, such as late weeknights or weekends when fewer users are online. This can help ensure a smoother experience.

2. Download the SSS mobile app

Consider downloading the SSS mobile app, which offers user-friendly and convenient access to SSS services. It’s available for both Android and Apple devices. The app provides the same features as the My.SSS Member Portal, allowing you to transact with the SSS on the go.

The mobile app is free and compatible with Android (4.4 Kitkat or higher) and Apple (iOS 8.0 or higher) devices. You can download it from the Apple App Store or Google Play Store.

Once you’ve installed the app, access your account using your user ID and password.

3. Keep a copy of your user ID and password

Always keep a copy of your user ID and password in a secure place. This prevents the inconvenience of needing help from SSS support if you forget your login credentials. Never share your login details with anyone to maintain account security.

4. Change your password every 3 months

For security reasons, change your password every 90 days. To do this, log in to your My.SSS account, navigate to Member Info, and select Change Password. Follow the prompts to update your password.

5. Members and small employers who don’t have a personal computer, Internet access, or both can also register and access their My.SSS accounts at any SSS branch

Each e-Center also has SSS member service representatives who are always ready to assist those who aren’t computer literate or need technical assistance.

If you or someone you know don’t have any means to connect to the Internet and aren’t adept with computers, proceed to the e-Center of any SSS branch to check how many SSS contributions you’ve paid so far, apply for SSS loans/benefits, and avail of other online services.

6. SSS now implements a ‘no web registration, no salary loan’ policy

SSS has implemented a policy where online registration is a requirement for applying for a salary loan. As of November 11, 2019, all salary loan applications must be filed online. Other loan types, like Calamity, Educational Assistance, and Emergency loans, still require filing at SSS branches.

7. Beware of Fixers and Scammers who are offering assistance with your SSS online registration

Entrusting your personal information and My.SSS login credentials to a stranger will result in your account getting compromised. Not only are you paying exorbitant fees for something you can easily do on your own, but you’re also giving away vital information to someone who can run away and use the same knowledge against you.

Worse, you may even pay the penalty or get behind bars as illegal activities of fixers, and anyone conniving with these fixers is punishable by law, as per R.A. 11199 (Social Security Act of 2018) and R.A. 11032 (Ease of Doing Business and Efficient Government Service Delivery Act of 2018).

If you need assistance with SSS online registration, you may get it from the following legit and official SSS channels:

In case you have come across a fixer or any illegal transaction with SSS, don’t hesitate to report it at the nearest SSS branch or to the Special Investigation Department of the SSS by emailing fid@sss.gov.ph, calling telephone numbers 8920-6401 locals 5313 to 5316, or sending mail to 4th Floor, SSS Main Office, East Avenue, Diliman, Quezon City.

Frequently Asked Questions in SSS Online Registration

1. What do I need to register for SSS online?

You will need the following:

- A valid email address

- A mobile phone number

- A government-issued ID (e.g., passport, driver’s license, birth certificate)

2. How do I register for SSS online?

To register for SSS online, follow these steps:

- Go to the SSS Online Registration Page.

- Click the “Register” button.

- Select one piece of information you’ve previously registered in SSS.

- Input your basic information, including your contact information and home address.

- Create a username and password.

- Click the “Submit” button.

- You will receive an email confirmation from the SSS that your registration has been successful.

- Click the link in the email confirmation to activate your account.

3. What if I don’t have an email address or a mobile phone number?

If you don’t have an email address or a mobile phone number, you cannot register for SSS online. You will need to visit an SSS branch to register in person.

4. What if I don’t have a government-issued ID?

If you don’t have a government-issued ID, you can use other valid documents to verify your identity, such as your school ID, employee ID, or company ID.

5. What information do I need to provide when registering for SSS online?

You will need to provide the following information when registering for SSS online:

- Full name

- Date of birth

- Gender

- Civil status

- Nationality

- Contact information (email address and mobile phone number)

- Home address

- Government-issued ID number

- Educational background

- Employment status

- Estimated monthly earnings

6. How do I create a strong password for my SSS online account?

Your SSS online account password should be at least 8 characters long and contain a mix of upper and lowercase letters, numbers, and symbols. Avoid using easily guessed words or phrases, such as your name, birthday, or address.

7. What should I do if I forget my SSS online account password?

To reset your SSS online account password, follow these steps:

- Go to the SSS Online Registration Page.

- Click the “Forgot Password?” link.

- Enter your username and email address.

- Click the “Submit” button.

- You will receive an email with a link to reset your password.

- Click the link in the email and follow the instructions to reset your password.

8. How do I activate my SSS online account?

To activate your SSS online account, click the link in the email confirmation you received after registering.

9. What can I do with my SSS online account?

With your SSS online account, you can:

- View your SSS contributions and benefits

- Update your personal information

- File and pay your contributions online

- Apply for SSS loans

- Request for SSS statements

- Generate your e-BIR Form 2316

10. Can I register for SSS online if I am already an overseas Filipino worker (OFW)?

Yes, you can register for SSS online if you are an OFW. You will need to use your Philippine address and mobile phone number when registering.

11. Can I register for SSS online if I am a self-employed individual?

Yes, you can register for SSS online if you are a self-employed individual. You will need to estimate your monthly earnings when registering.

12. What if I make a mistake when filling out the SSS online registration form?

You can go back and correct any mistakes you made in the SSS online registration form. Just click the “Back” button and make the necessary changes.

13. Can I submit my SSS online registration form without completing all of the fields?

No, you cannot submit your SSS online registration form without completing all of the fields. All of the fields marked with an asterisk (*) are required.

14. How long does it take to process my SSS online registration?

It usually takes 3-5 working days to process SSS online registrations.

15. How will I know if my SSS online registration has been processed?

You will receive an email notification from the SSS once your online registration has been processed.

16. What should I do if I don’t receive an email notification from the SSS after registering online?

If you don’t receive an email notification from the SSS after registering online, you can contact the SSS Hotline at 1455 or send an email to them.

17. What are the benefits of being an SSS member?

SSS members are entitled to the following benefits:

- Social security pension

- Retirement pension

- Disability pension

- Death pension

- Maternity benefit

- Sickness benefit

- Employment injury benefit

- Funeral benefit

18. How much are the SSS contributions?

SSS contributions are based on the member’s monthly earnings. The current contribution rate is 13%, with 3.25% paid by the employer and 9.75% paid by the employee.

19. How can I pay my SSS contributions?

You can pay your SSS contributions online, over-the-counter at any SSS branch, or through designated partner banks and payment centers.

20. What happens if I miss my SSS contributions?

The Social Security System (SSS) typically does not allow retroactive payments of contributions. Missing a monthly contribution does not necessarily result in losing your entitlement to SSS benefits. However, it’s essential to understand that certain SSS benefits require a specific number of contributions before members become eligible to claim them.

21. How to Change Company Email Address or Authorized Signatory for My.SSS Account Access?

If you need to change the company email address registered in your Employer account or update the authorized signatory due to personnel changes, follow these steps:

- Send an online change request via email to onlineserviceassistance@sss.gov.ph.

Include the following documents in your email:

a. A formal Letter of Request for the change of User ID, company email address, or authorized signatory. Include the complete name, SSS number, and personal email address of the designated authorized signatory if updating. The letter must be signed by the person appearing on the Specimen Signature Card (SS Form L-501).

b. UMID card or two (2) valid IDs of the designated authorized signatory.

c. Valid SS Form L-501 with one-year validity, received and stamped by your SSS servicing branch, including the name of the designated authorized signatory.

22. What Does “Invalid SSS Number” Mean, and How to Resolve It?

If you encounter an “Invalid SSS Number” message during online registration, consider these solutions:a. Verify the accuracy of your SSS number and ensure it’s in the correct format. Retype the number if necessary.

b. Check if you already have an existing SSS online account. If so, request an online account reset by emailing online onlineserviceassistance@sss.gov.ph or visiting an SSS branch.

c. If your SSS number is correct but still “invalid,” contact SSS for assistance and verification of your membership status.

23. What Should I Do If My Online Registration Fails?

If your online registration is unsuccessful, follow these steps:

- Review the SSS email that explains the reasons for your unsuccessful registration.

- Correct any discrepancies, such as name or birthdate, in your registration information and try again.

- Consider using an alternative registration option, such as UMID Card or other available information.

- If the issue persists, contact the SSS Member Electronic Services Department at (02) 920-6401 or email onlineserviceassistance@sss.gov.ph, providing details of your concern, complete name, 10-digit SSS number, a clear screenshot of the error message, and an image of your UMID card or valid ID.

- If you don’t receive a response, consider reaching out on the SSS Facebook page or visit a nearby SSS branch for assistance.

24. Is SSS Online Registration Mandatory?

While there is no legal requirement for all members to register online and create My.SSS accounts, it is highly encouraged. Most SSS transactions are now conducted online, including applications for salary loans and cash benefits. Without a My.SSS account, members may miss out on these services.

25. Can Employers Access Employees’ SSS Records Through My.SSS?

No, employers are legally prohibited from accessing individual employee records through My.SSS. Employee records are confidential under the Social Security Act of 1997 and the Electronic Commerce Act of 2000. Access is only allowed with the consent of the SSS President or authorized officials, and for specific authorized purposes.

26. How to Resolve “CRN/SSS Number Already Registered” Error During Registration?

If you encounter a “CRN/SSS Number has already been registered” error, seek assistance by visiting an SSS branch, calling the SSS hotline at 1455, or emailing onlineserviceassistance@sss.gov.ph. Alternatively, comment on recent posts on the Philippine Social Security System Facebook Page.

27. What to Do If You Get “User ID Already Exists” or “Email Address Already Exists” Errors During SSS Registration?

If you receive these errors, it means the information you’re providing already exists in the SSS database. To proceed, choose a different user ID or email address.

28. Can’t Find SSS Activation Link Email? What to Do?

Check your SPAM or Trash folder for the activation link email. If it hasn’t arrived, wait for up to an hour. If the issue persists, ensure that your network administrator is not blocking emails from sss.gov.ph. Finally, request technical assistance at [email protected], providing details of your problem, your name, SSS number, and attached copies of your UMID or two valid IDs.

29. How to Change My Designated SSS User ID?

Once your SSS online registration is approved, your User ID becomes permanent. However, you may request a change for compelling reasons. Send a formal letter to the nearest SSS branch or email at onlineserviceassistance@sss.gov.ph, explaining the reason for the change and attaching scanned copies of your UMID card or two valid IDs with your photo and signature.

Additional tips:

- It is important to register for SSS as soon as possible, even if you are not employed yet. This is because your SSS contributions will earn interest, which will increase the amount of your benefits in the future.

- You can update your SSS contributions if you change jobs or your income increases.

- You can also apply for voluntary contributions if you want to increase your SSS benefits.

- You can visit the SSS website or call the SSS Hotline at 1455 for more information on how to register for SSS online and how to pay your SSS contributions.

Conclusion

SSS online registration is an essential service that provides members with a convenient and efficient way to manage their SSS membership. Take advantage of the many benefits it offers and register your account and control of your SSS membership.

References

- www.sss.gov.ph – Official SSS Website

- Republic Act No. 8792 (Electronic Commerce Act of 2000)

- Republic Act 8282 (Social Security Act of 1997)

Recent Posts

PSHS NCE Results 2023 (AY 2024-2025): Complete List of Passers Announced - Check Your Name Now!

As the anticipation builds, the Philippine Science High School System (PSHS) is gearing up to unveil the highly awaited results of the Philippine Science High School-National Competitive Examination...

OWWA Scholarship 2024 Programs for Filipino Students: Application, Requirements, and Process Guide

Education is the cornerstone of a bright future. However, the road to achieving academic dreams can often be hindered by financial constraints. This is particularly true for the families of Filipino...